FAME will provide the means for integrating, pricing and trading data assets from interconnected, federated data management infrastructures, including heterogeneous data spaces and data marketplaces. Likewise, it will allow for aggregating and integrating data assets from different providers in a federated catalogue (FDAC). As such, various pilot projects aim to test and validate FAME technologies in real world environments and use cases, offering solutions for financial institutions, Fintech companies, and other end-users. This article presents insights into FAME’s Pilot #3.

Enhancing Anti-Money Laundering (AML) Capabilities in Embedded Finance

As the financial services landscape continues to evolve, the need for robust Anti-Money Laundering (AML) measures becomes increasingly critical, especially within the context of Embedded Finance (EmFi). Pilot #3, a collaborative initiative involving the Banking and Payments Federation Ireland (BPFI), the National University of Ireland Galway (NUIG), Bank of Ireland (BOI), and JRC Capital (JRC), is at the forefront of addressing these challenges through innovative AML solutions. This article delves into the AML model proposed by Pilot #3 and its implications for the financial ecosystem.

The Importance of AML in Embedded Finance

Embedded Finance integrates financial services into non-financial platforms, creating new opportunities for businesses and consumers alike. However, this integration also presents unique challenges in terms of compliance and security. Money laundering remains a significant threat, with criminals continually seeking to exploit gaps in financial systems. Therefore, incorporating effective AML strategies into EmFi offerings is essential to protect financial institutions and maintain the integrity of the broader financial ecosystem.

Innovative AML as a Service

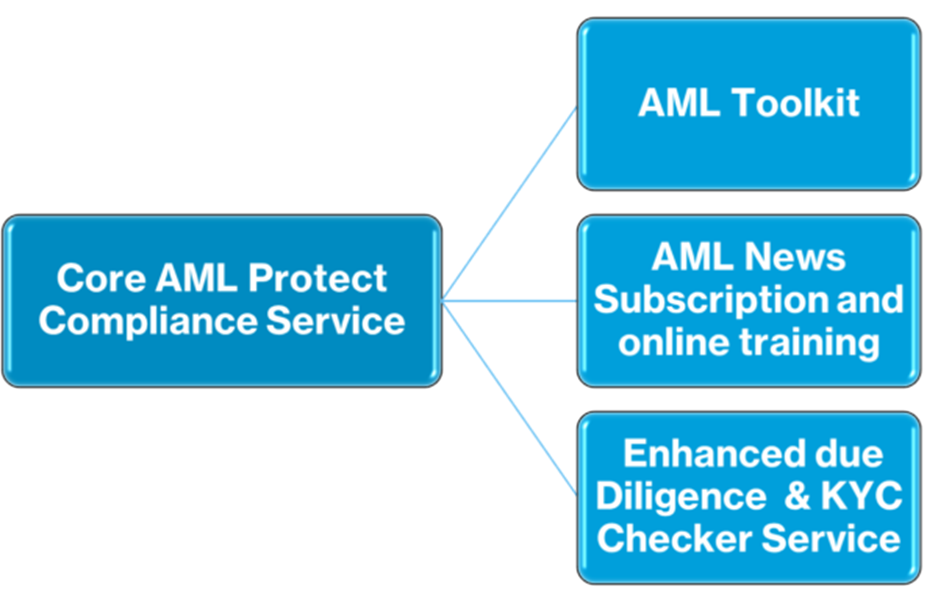

FAME’s Pilot #3 aims to address these challenges by introducing an innovative approach to AML through its “AML-as-a-Service” model. This framework is designed to support EmFi application developers by providing them with tools and insights to conduct thorough AML checks. Here’s how this model enhances AML capabilities:

- Data Aggregation and Analytics: The AML-as-a-Service model leverages data aggregation from multiple sources to create a comprehensive view of customer activities. By analyzing transaction patterns and behaviors, the system can identify anomalies that may indicate potential money laundering activities.

- Real-Time Monitoring: The model incorporates real-time monitoring capabilities, allowing for immediate detection of suspicious transactions. By continuously analyzing transaction data, the system can flag activities that deviate from established norms, enabling timely intervention.

- Risk Scoring: A sophisticated risk scoring mechanism evaluates the likelihood of a transaction being linked to money laundering. By assessing various risk factors, such as customer profiles and transaction histories, the model helps financial institutions prioritize their investigative efforts.

- Integration with Existing Systems: The AML-as-a-Service solution is designed to seamlessly integrate with existing financial systems. This interoperability ensures that financial institutions can enhance their AML capabilities without overhauling their current infrastructure.

- Regulatory Compliance: With evolving regulatory requirements, the AML model within Pilot #3 ensures compliance with the latest AML regulations. By automating compliance processes and providing necessary documentation, financial institutions can reduce the burden of regulatory adherence.

Addressing Challenges in Traditional Banking

Traditional banks often face reluctance to adopt third-party solutions due to concerns about data security and potential disruptions to their operations. However, the AML-as-a-Service model addresses these challenges by providing a secure, compliant framework that enhances existing AML practices without compromising the integrity of traditional banking systems. By promoting collaboration and data sharing among financial institutions, Pilot #3 aims to build trust and encourage the adoption of innovative AML solutions.

Pilot #3’s AML-as-a-Service model represents a significant advancement in the fight against money laundering within the Embedded Finance landscape. By leveraging data aggregation, real-time monitoring, and risk scoring, this innovative approach equips financial institutions with the tools they need to identify and mitigate potential risks associated with money laundering. As the pilot progresses, it is poised to set a new standard for AML practices in the financial sector, fostering a more secure and compliant financial ecosystem for all stakeholders involved.

Advancing AML Strategies in Embedded Finance

Recognizing the critical role of Anti-Money Laundering (AML) in the evolving landscape of Embedded Finance (EmFi), JRC is committed to integrating cutting-edge AML solutions that safeguard the integrity of financial ecosystems. The increasing adoption of EmFi, which seamlessly embeds financial services into non-financial platforms, has created unparalleled opportunities but also heightened vulnerabilities to financial crimes such as money laundering. By collaborating with experts in compliance, data security, and EmFi technology within the framework of the Pilot #3 initiative, JRC Capital is pioneering innovative AML methodologies. This initiative not only enhances AML compliance capabilities but also strengthens trust in EmFi platforms, ensuring that businesses and consumers alike can navigate this new frontier securely. As financial services become more decentralized, JRC aims to remain a leader in developing scalable, efficient, and effective AML solutions tailored for the EmFi space.

Fostering Responsible Embedded Finance Practices

JRC’s participation in FAME Pilot #3 reflects its broader mission to foster responsible financial practices in the rapidly growing Embedded Finance sector. By emphasizing transparency, accountability, and compliance, the firm is empowering businesses to adopt EmFi solutions that align with global AML regulations and ethical standards. The development of the “AML-as-a-Service” framework exemplifies JRC’s commitment to innovation, offering tools for real-time transaction monitoring, risk assessment, and seamless integration with existing platforms. This approach not only reduces the operational burden of compliance for businesses but also promotes a safer and more sustainable financial ecosystem. As the financial landscape continues to evolve, JRC remains dedicated to leveraging advanced technologies to create secure, compliant, and client-focused solutions that protect against emerging financial risks.

—

Subscribe to our newsletter for the latest updates, and follow FAME on LinkedIn and X to be part of the journey.

More info:

JRC